Two years after end of Great Recession, how are we doing?

Loading...

| Poughkeepsie, N.Y.

Next month marks two years since the end of the Great Recession, the worst economic downturn in 75 years.

Since then, how has recovery gone? And where is the economy headed?

If someone lost his job in the recession, he might be answering, "What recovery?" If somebody had to sell her house, she might wonder why she ever bought it in the first place. But for anyone who put money into the stock market at a time when the economic outlook was blurry, the answer might be quite different.

Indeed, the economic recovery has either been disappointing or "just fine, thank you."

How Americans feel about the recovery is fairly important – to the recovery itself. If consumers have a sour outlook, that can influence their decisions to buy, for example, new cars or appliances. Big business is adept at sensing this consumer mood, which could govern whether companies hire more workers. And more hiring is what's needed for the economic recovery to continue.

In addition, Americans' attitudes about their economic situation is likely to be the crucial factor when they vote next year in the presidential election, as well as in other political races.

Currently, for the most part, Americans are dubious about whether the economy is performing well. In a poll of 1,013 people conducted between April 20 and 23, the Gallup Organization found that 55 percent still think the economy is in a recession or depression. Another 16 percent say the economy is slowing down. Only 27 percent think it is growing.

"Whatever the economic statistics say, it is not a strong enough recovery so people see it in their daily lives," says Dennis Jacobe, chief economist for Gallup.

In large part, that's because the recovery has been "uneven," explains Mark Zandi, chief economist of Moody's Analytics in West Chester, Pa.

"Some big businesses, big banks, wealthy households have done pretty well," he says. "But for a small business, a small bank, it still feels like a recession."

For many Americans, that's not hard to understand considering that the unemployment rate, which peaked at 10.1 percent in October 2009, was 9 percent last month. Home prices, which are how many people estimate their wealth, have fallen 30 percent since 2006, according to Standard & Poor's/Case-Shiller index of 20 cities. And the nation's gross domestic product, a broad measure of its total output of goods and services, has had an average growth rate of 2.78 percent over the past seven quarters – much slower than after most recessions.

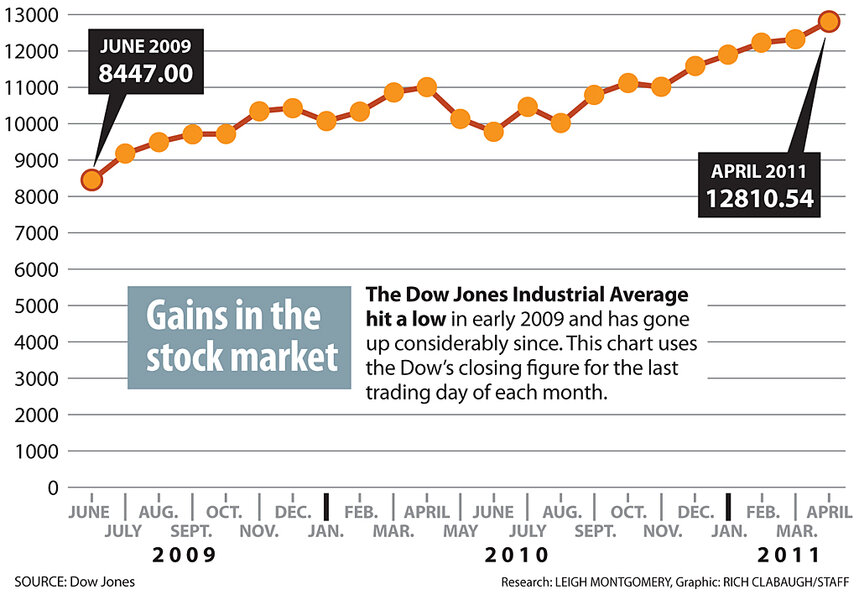

However, the recovery looks more robust if you have investments in the stock market.

Since its low in March 2009, the S&P 500 stock index has gone up 105 percent. In late April, the Dow Jones Industrial Average powered to a three-year high, up 98 percent.

"Corporate America, excluding the banks, came through the financial crisis in great shape in terms of their balance sheet," says Fred Dickson, chief investment strategist at D.A. Davidson & Co. in Lake Oswego, Ore. "They have enjoyed accelerating revenue and profit."

Those rising stock prices have certainly helped one group: billionaires. Two years ago, according to Forbes Magazine, there were 359 US billionaires, controlling $1.061 trillion in wealth. The magazine's assessment for 2011 found 412 US billionaires with wealth totaling $1.484 trillion.

Yet on Main Street, the view is somewhat different.

The Hudson Valley community of Poughkeepsie, N.Y., about a two-hour drive from New York City, has seen a lot of stresses and strains. But it also shows how the economy can be resilient.

Poughkeepsie is the county seat for Dutchess County. As such, it has a certain amount of built-in stability from courts, law firms, and hospitals.

The Brookings Institution's Metropolitan Policy Program puts Poughkeepsie's economy in the middle of the 100 metro areas it measures. Most of those "middle" cities have some mix of government, education, health care, professional services, and food service, says Mark Muro, policy director of the program.

But that did not insulate Poughkeepsie economically.

As a result of the recession, the city's revenues fell $3.5 million, and Mayor John Tkazyik had to cut the city's workforce by 10 percent, mainly through attrition. "We cut overtime, we cut contracted services, we are cutting out the waste," says Mr. Tkazyik in an interview at his office.

But at the same time, the city is attracting developers through various incentives. At least 35 projects – ranging from condos to new medical facilities to a $25 million office and shopping complex on the banks of the Hudson River – are in the works, says Michael Long, the city administrator. "We have a handful of developers who want to turn this city around," he says.

One of those is New York-based Hudson-York Capital, which has invested in a number of mixed-use projects. "I am optimistic about the economy," says Jacob Frydman, the firm's managing partner, adding that Poughkeepsie has a good combination of culture, mass transit, and affordable homes.

This is not to say that everything in Poughkeepsie is coming up roses. At the Take 5 Deli, an employee says the eatery has gone from five workers to three. "Business is off about 50 percent," she says.

But new jobs are being created in retail, the medical field, professional services, and tourism, says Mr. Long. As a result, the unemployment rate in the metro area has fallen to 7.7 percent.

Poughkeepsie is even benefiting from a national trend – an uptick in exports. Dorsey Metrology International, which produces precision measuring equipment, is working on projects in Turkey and Malaysia. "We are out of space and are looking to add space and people," says Ted Luty Jr., the president.

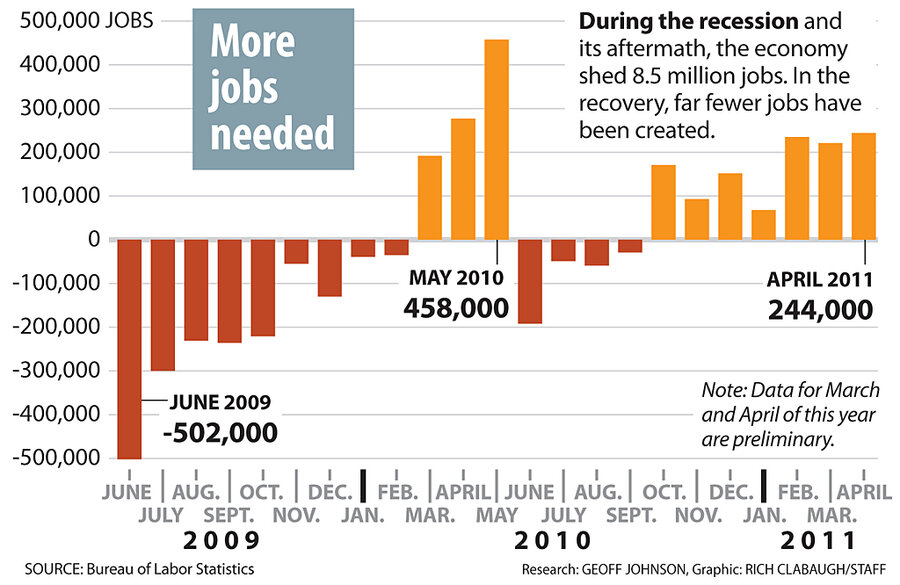

Although Poughkeepsie is showing some hopeful signs, many Americans overall feel that the economy is still struggling – mainly because of the slow recovery in employment. After shedding 8.5 million jobs, the economy has created only 1.7 million new jobs since.

The past three months have seen some improvement. Some 244,000 new jobs were created in April, the Labor Department reported, and that followed job gains of 221,000 in March and 235,000 in February.

Yet the number of Americans who have been out of work for six months or longer remains high – officially about 5.8 million in April, only a slight improvement from a year ago.

A major roadblock for those looking for work: Corporate America adopted the mantra "do more with less." Managers have pushed employees to produce goods more efficiently or just work a little longer.

Nonfarm productivity increased by 3.7 percent in 2009 and rose again by 3.9 percent in 2010, according to the Bureau of Labor Statistics.

"In the aftermath of a lot of layoffs, productivity is usually quite strong," says John Challenger, an employment expert and the head of Challenger, Gray & Christmas, a Chicago outplacement company.

At the same time, the number of mass layoffs (involving at least 50 workers) has been shrinking. In March, businesses implemented 1,286 mass layoffs involving 118,523 workers, reports the Bureau of Labor Statistics. This was the lowest level since the fall of 2007.

"My sense is that people who have a job feel it's probably safe," Mr. Challenger says.

People who have been looking for work for some time say they are seeing some hiring. Take Jenny Hong, whom the Monitor profiled in a story last year. In 2008, she and her husband, Dave, moved from Michigan to Columbia, S.C., in search of work.

Mr. Hong landed a job, but Ms. Hong, who has bookkeeping and administrator skills, could not find anything. She started an online forum for other out-of-work people.

After months of "not even getting a call back" from the companies she sent her résumé to, she's working two part-time jobs, she says. And she's more optimistic about her search for full-time work. "I see more out there," she says.

One of Hong's concerns: the price of gasoline.

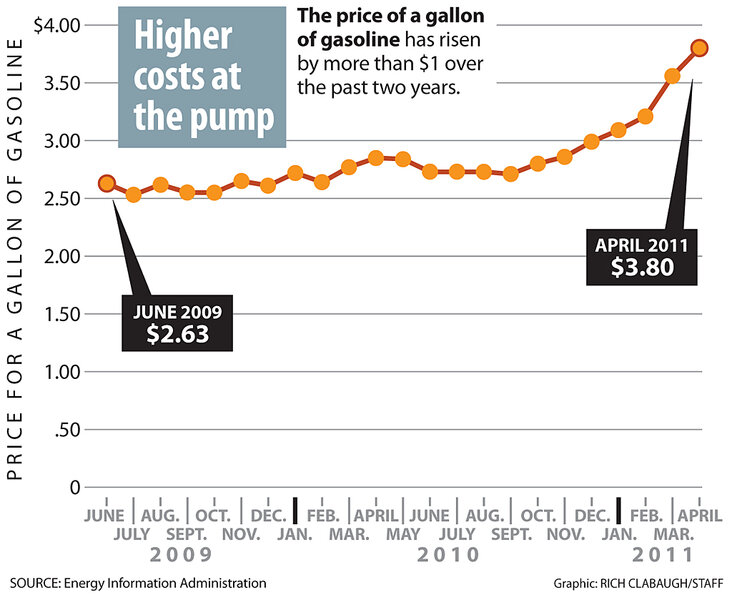

Indeed, over the past two years, that cost has risen considerably. In June 2009, the price of a gallon of gas was $2.63, according to the Energy Information Administration. By the beginning of this month, it was up to $3.98 – an increase of $1.35.

However, analysts expect gasoline prices to fall at least 40 cents a gallon by midsummer.

The price of gas may not seem like something that would concern the Federal Reserve. But the nation's central bank has been watching the rise carefully because of inflation concerns, said Fed Chairman Ben Bernanke at the end of April.

Falling gasoline prices would be a relief to Souriya Inthirath, who works as a bartender at Bull and Buddha in Poughkeepsie. Mr. Inthirath drives an hour in his SUV to get to his job. Back when gasoline was $3.20 a gallon, a dollar per gallon less than he pays now, fuel cost him $400 a month. Now, he's "definitely" going to look for a vehicle that's more economical or find a way to cut down on his commute.

Aside from gasoline prices, another weight on the economy is the housing market. Overall, the value of US homes has fallen about $7 trillion since 2006, says Mr. Zandi, using Federal Reserve data. "On a real basis, home equity is back to 40 to 50 years ago," he says.

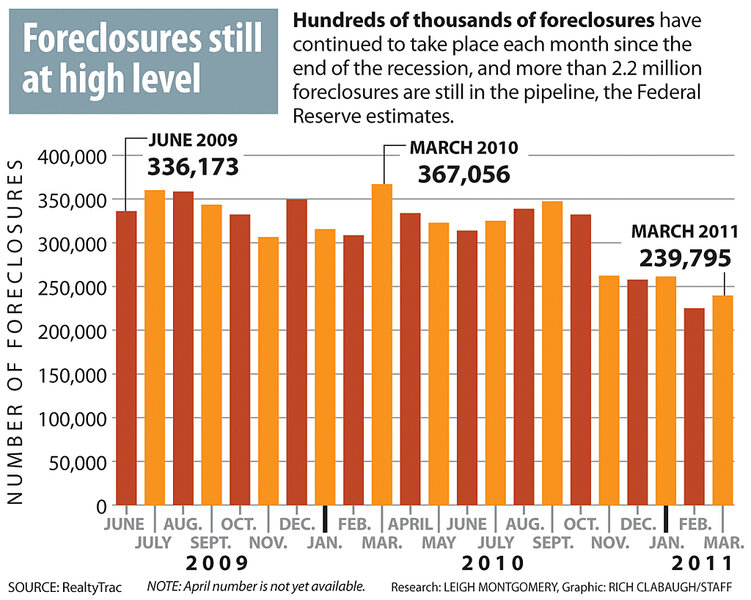

Home prices hit bottom in 2009, but now, some economists think a "double dip" in prices is taking place. The main reason, says economist Patrick Newport of IHS Global Insight in Lexington, Mass., is the huge number of foreclosures still in the pipeline – estimated by the Fed to be more than 2.2 million.

Mr. Newport expects home prices to fall another 5 percent this year. But if the labor market continues to gain ground, the number of foreclosures should drop. "Our projection is that things will begin to improve going forward, but at a slow pace," Newport says. "We won't be back to normal until 2014."

An improving housing market in Poughkeepsie could be a harbinger for the rest of the nation. Home prices fell 10 percent last year and are down 5.5 percent this year, says Gene DeMarco, the city commissioner of assessment. But, he says, he recently saw a house sell for $340,000 after initial estimates that it would go for $240,000 to $275,000.

"The houses that sell seem to be selling for decent amounts," he says.