Is the Obama health-care law a huge tax increase?

Loading...

| New York

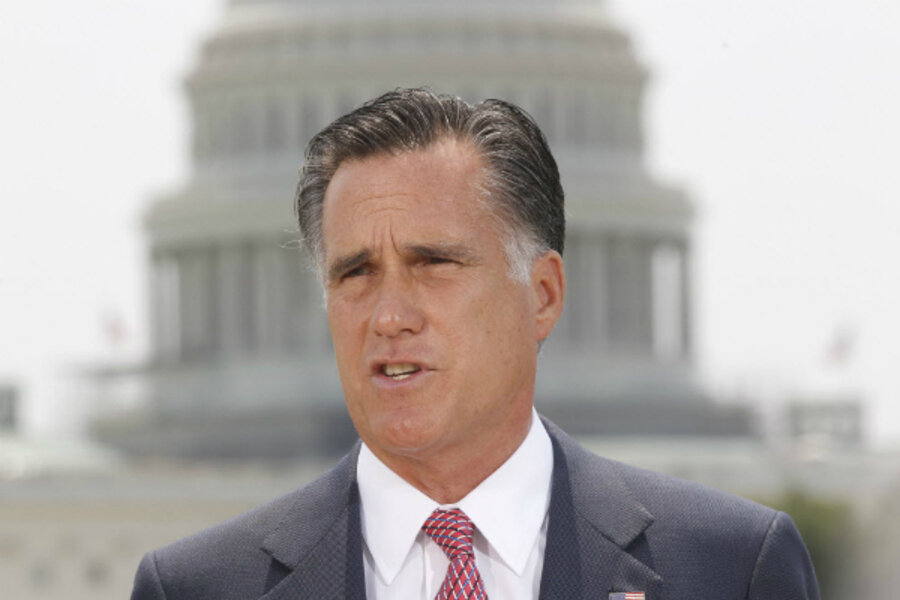

To Republicans, including presidential candidate Mitt Romney, the Affordable Care Act is a mega tax increase that will be paid by everyone from low income Americans and small businesses to gigantic corporations.

“Obamacare raises taxes on the American people by approximately $500 billion,” said Mr. Romney, responding to the Supreme Court's historic health-care ruling outside the Capitol on Thursday.

For good measure, American Crossroads, the most influential of the conservative "super political-action committees," is launching a national cable TV ad campaign Saturday that claims that health-care reform is a tax hike on the middle class.

“Now it’s official," the ad claims. "Obama increased taxes on struggling families. The middle class takes another hit.”

Are Romney and his conservative allies correct?

The short answer is a qualified yes. The health-care law does amount to a tax increase, but this increase will mainly hit high-income Americans, such as Romney, who has historically paid much lower tax rates than many middle-income Americans.

If anything, Romney's numbers, which are based on prior government estimates that go out only to 2019, might be low. “If you go out to 2022, it will raise [taxes] $800 billion to $1 trillion,” says Marc Goldwein, senior policy director at the Committee for a Responsible Federal Budget in Washington.

Included in the legislation are several major revenue raisers on individuals or companies to pay for the expansion of health-care coverage.

• First is a surcharge of 0.9 percent on the Medicare taxes paid on wages of $200,000 a year for those filing singly or $250,000 for those who are married and filing jointly.

• In addition, there is a 3.8 percent tax on unearned income of over $250,000, such as dividends and capital gains.

According to the congressional Joint Committee on Taxation, these taxes alone are estimated to raise $210 billion over 10 years or about 40 percent of the new revenue. Since Romney gets most of his income from passive investments, based on his income of $42 million over a two-year period, he would owe an additional $1.6 million.

• Another major tax increase is new taxes or fees on medical devices, drug manufacturers, and importers of medical devices. The Congressional Budget Office estimates this group would bring in an additional $107 billion over 10 years.

• There is also a surcharge on high-cost health-insurance plans, which will be mainly borne by the wealthy. Labor unions, which have given up pay increases for benefit increases, have a short exclusion from the surcharge. Over 10 years, this will raise $32 billion.

• And, finally, the legislation includes penalties on individuals who do not get insurance and companies that don’t offer it. The actual penalties start relatively low – a penalty of the greater of $95 or 1 percent of income in 2014, $325 or 2 percent of income in 2015, and $695 or 2.5 percent of income in 2016 and beyond. This is expected to raise $17 billion over 10 years from individuals and $52 billion from corporations.

Former chairman of the House Budget Committee, Rep. John Spratt (D) of South Carolina, says that the idea of the additional taxes on the well-to-do was to even the playing field.

“These people have access to health care, their companies can deduct the cost of their insurance plans, and they can exclude the costs from their taxable income,” says Mr. Spratt, who was defeated for reelection in 2010. “They have an advantage, and we felt the taxes would level the benefit advantage out.”

Republicans are incensed over the forthcoming tax hikes.

“After two years of deception it's time for Obamacare supporters to come clean and level with Minnesotans about what they actually did,” says Pat Shortridge, chairman of the Republican Party in Minnesota. “In the coming days, I hope they will apologize for not telling Minnesotans the truth about the tax increases that are the cornerstone of the Affordable Care Act, and level with their constituents about the negative effect this law will have on family budgets, health care quality, and job opportunities."

Sen. Lindsey Graham (R) of South Carolina said: “The problem for the American people is this is a massive tax increase at a time they can least afford it and Obamacare will jeopardize the quality and accessibility of health care.”

However, supporters of the legislation say there is a point to the new taxes.

“It is not as if the additional tax revenue will be burned up in a furnace,” says Paul Van de Water, a senior fellow at the Center for Budget and Policy Priorities, a think tank in Washington. “The revenue will help support the Medicaid expansion and the tax credits for people buying health insurance at the new health-insurance exchanges,” he says referring to a part of the plan that sets up a place for individuals to buy health insurance if they are not covered.

Adding the Medicaid expansion and individual mandate for health care is expensive, says Spratt. “We had to make sure it was deficit neutral so we needed revenue.”