S&P/Case-Shiller: Home prices decrease

Loading...

Note... be sure to bookmark the overall S&P/Case-Shiller Dashboard or the Scary Housing Dashboard of the weakest markets for a real-time view of all the markets tracked by S&P.

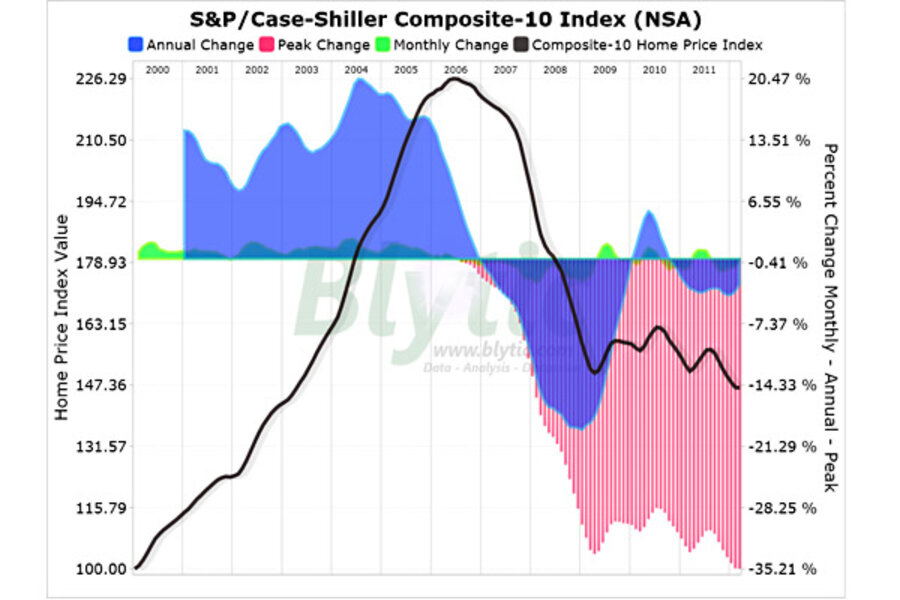

The latest release of the S&P/Case-Shiller (CSI) home price indices for March reported that the non-seasonally adjusted Composite-10 price index declined 0.09% since February while the Composite-20 index declined 0.03% over the same period resulting in the lowest level seen to on the Composite-10 since early 2003 and the largest peak decline seen since the nearly six year old housing bust began in 2006.

The latest CSI data clearly indicates that the price trends are experiencing a declining trend through the typically less active winter season and as I recently pointed out, the more timely and less distorted Radar Logic RPX data is continuing to capture notable rising prices driven primarily by seasonality.

The 10-city composite index declined 2.85% as compared to March 2011 while the 20-city composite declined 2.57% over the same period.

Both of the broad composite indices show significant peak declines slumping -35.21% for the 10-city national index and -35.07% for the 20-city national index on a peak comparison basis.