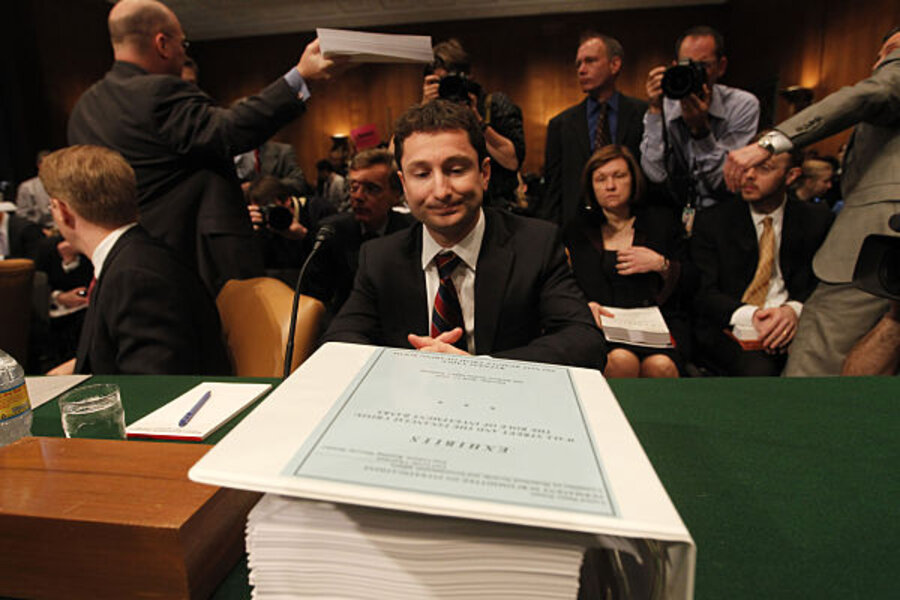

Goldman's Fabrice Tourre is a sideshow

Loading...

This week, “Fabulous Fab” Tourre was forced to appear before the US Senate. The senators may not have been able to tell a derivative from a hole in the ground, but they knew what the mob wanted – blood. The poor French lamb was bled on Tuesday.

Meanwhile, an Englishman wrote to the TIMES, suggesting that media was being distracted from the big story:

“Based on recent Budget reports, since 2001 the proportion of GDP spent by [the UK] government has increased from 47 per cent to 55 per cent of GDP. Over the same period total revenues decreased from 48 per cent to 42 per cent of GDP; while total expenditures increased by 70 per cent, total revenues increased by only 25 per cent…

“The rates of growth in expenditures in the three largest items are: social protection and services, 92 per cent; health; 102 per cent; and education, 76 per cent. The main sources of tax revenue increased by much less: the increases in the three largest sources of tax revenues are income tax, 36 per cent; national insurance, 56 per cent; and VAT, 1.6 per cent.”

He’s right. Fabulous Fab is a sideshow. The real story is fab finance. And at some point in the future, the effect of modern financial theory will become clear: it turns little problems into big ones.

Chesterton wrote that a landlady should consider a new boarder’s philosophy, not his bank account. But the financial whizzes cared nothing about philosophy. In every instance, they brushed aside qualitative judgments in favor of quantitative ones, turning trifling, idiosyncratic risks into systemic catastrophes. Naturally, Tourre comes from the math-mad French school system. All they care about is numbers. Because you can crunch them, massage them, and twist them into whatever shape you want.

If you look at the financial industry over the past two or three decades, you see more or less the same trends – economists turned into mathematicians, investors turned into gamblers, and finance professionals turned into conmen.

But behind these trends is a bigger one: little, current risks have turned into much bigger future ones. Mutual funds took away the risk of selecting a single bad company but they increased the risk that the whole stock market might become dangerously overvalued. Likewise, other new investment vehicles removed from the investor the burden of making his own decisions. He didn’t have to study balance sheets or meet company executives. He needn’t worry that his office building would be struck by lightning or that his favorite new technology would be upstaged by even newer technology. The investment industry made it easy for him. He could now act with the insouciance of a mortgage lender; he could buy an ETF or a REIT.

The man on the street found himself in a similar territory. No longer were his financial risks entirely his own. If he fell sick, he could count on the National Health Service in England…and now Obama’s new nationalized health care program in America. And in the largest financial takeover of all time, the government took on the burden of retirement finance too. Now the consumer could spend all his money, rather than save it. Grasshoppers and aunts – both got about the same government pension check. And now, society no longer faces the risk that some retirees will go broke; now it faces the risk that they all will.

The rise of the state corresponds to a decline in individual judgment. The idea was to eliminate the risks of personal failure by socializing them, much in the way an insurance company spreads the risk of fire hazard among hundreds of different homeowners.

Thus did the risk that one or two individual mortgages might go bad get replaced by the risk that the whole housing market would go bad. And instead of a relatively few bad decisions by a few bad bankers, we got a whole rotten mortgage industry. As for the risk that the homeowners might turn into pyromaniacs…the quants chose to ignore it. Then, in 2007, the whole town burned down.

The banks took horrible losses. The state rushed to the scene. It put out the fire at AIG, for example, and thereby kept the sparks off Goldman’s roof. Iceland…Greece…Britain…the US – all poured liquidity onto the small forest brushfires…while debt tinder piled up in their public accounts. The big banks were saved. But now, government’s own credit is at risk. From the householder to the mortgage lender to the big banks to the small governments to the big governments – fab finance pushes the costs of error into the future and onto a bigger and bigger pool of chumps.

Add/view comments on this post.

------------------------------

The Christian Science Monitor has assembled a diverse group of the best economy-related bloggers out there. Our guest bloggers are not employed or directed by the Monitor and the views expressed are the bloggers' own, as is responsibility for the content of their blogs. To contact us about a blogger, click here. To add or view a comment on a guest blog, please go to the blogger's own site by clicking on the link above.