Tishman deal fails: sign of trouble in commercial real estate

Loading...

| New York

The largest real estate deal ever has failed.

On Monday, Tishman Speyer BlackRock, one of America’s largest commercial property owners, threw in the towel. They sent their $5.3 billion investment in 11,000 apartments in New York back to their bankers – the same way some homeowners are mailing their keys back to lenders.

The Tishman Speyer move involved two massive middle-class housing developments in Manhattan: Stuyvesant Town and Peter Cooper Village. The two complexes, consisting of 56 buildings, had been purchased in 2006 from MetLife. Since then, residents of both complexes had mounted intense legal and political opposition to Tishman Speyer’s attempt to raise rents and evict longstanding tenants.

The problems at Tishman Speyer, some analysts believe, are “symptomatic” of commercial real estate problems around the United States.

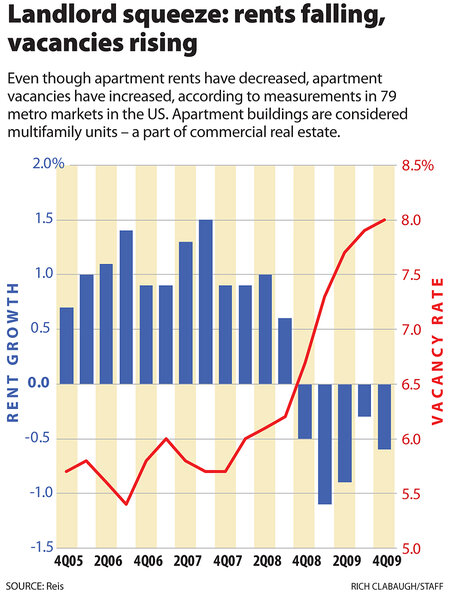

Many loans made to developers between 2005 and 2007 assumed rising rents and low vacancy rates. And developers believed that corporations – key tenants – would continue to expand their employment, not shrink it. So they erected new office towers. But many companies instead have laid off workers. Since a smaller workforce needs less space, these companies have tried to sublet their extra space. This has just added to the glut of space.

Moreover, some of the loans were for retail space. The developers of shopping centers never expected that the consumer would stop buying the latest fashion trends or new furniture for their homes.

"Not since the early 1990s have we observed this perfect storm of deteriorating rents and occupancies, deflating sales prices, and tight credit that's leading to a lot of defaults,” writes Victor Calanog, director of research at Reis, a New York-based real estate research organization, in an e-mail. “With close to $3.5 trillion of loans outstanding and at least 12 to 24 more months of rent declines, I expect to see more commercial properties defaulting on loans."

Of that $3.5 trillion, some $120 billion needs to be refinanced this year, according to the Mortgage Bankers Association. Normally, this wouldn’t be difficult. But now, there is far less income from the original loan to make the payments.

On top of that, lenders are more conservative – requiring much larger equity and no longer lending as much as 95 percent of the value of a property.

For example, as Mr. Calanog writes, in 2005, lenders were willing to lend up to 95 percent of the value of a property when dealing with a $100 million, five-year loan. That came out to $95 million.

But fast-forward to today: Now, the property is valued at $60 million, reflecting lower rents and occupancy. And lenders will no longer lend 95 percent, but rather 60 percent. That’s $36 million for the same property that they lent out $95 million in 2005.

“The difference between $95 million and $36 million is what we call the ‘equity hole.’ Because if the property really needs to borrow $95 million to keep things afloat, it will have to cough up the difference out of pocket, or from whatever pocket it can find,” Calanog says.

Yet the case of Stuyvesant Town is not a theoretical loan. Calanog estimates the total nominal outstanding debt at $4.4 billion, but the underlying property to be valued at only between $1.5 billion to $2 billion.

US banks have been steadily building their reserves to account for their losses in the commercial real estate market, says Fred Fraenkel, chairman of investment policy at Beacon Trust Co. in Madison, N.J.

“They have been increasing their loan losses by billions of dollars per bank per quarter,” he says.

In fact, the problems in the commercial real estate market will keep the economy from rebounding more strongly, Mr. Fraenkel thinks. And they will be a factor in the Fed’s decision on raising interest rates, he says.

Last year, Federal Reserve Chairman Ben Bernanke talked about the possibility that the Fed might have to supply up to $1 trillion to prevent the commercial real estate market and some other areas, such as the student-loan market, from collapsing.

While the residential housing market has finally stabilized, some analysts expect the commercial real estate market to continue to slide in value.

“Nonresidential construction is about midway through its downturn,” predicts Patrick Newport, a housing economist at HIS Global Insight in Lexington, Mass.

But it could get worse, Mr. Newport worries, because a lot of hedge funds and other real estate investors are now investing in Brazil and China, which are growing faster than the US.

“If people are not putting up money here, the commercial real estate market may stagnate for sometime,” he says.

-----

Follow us on Twitter.