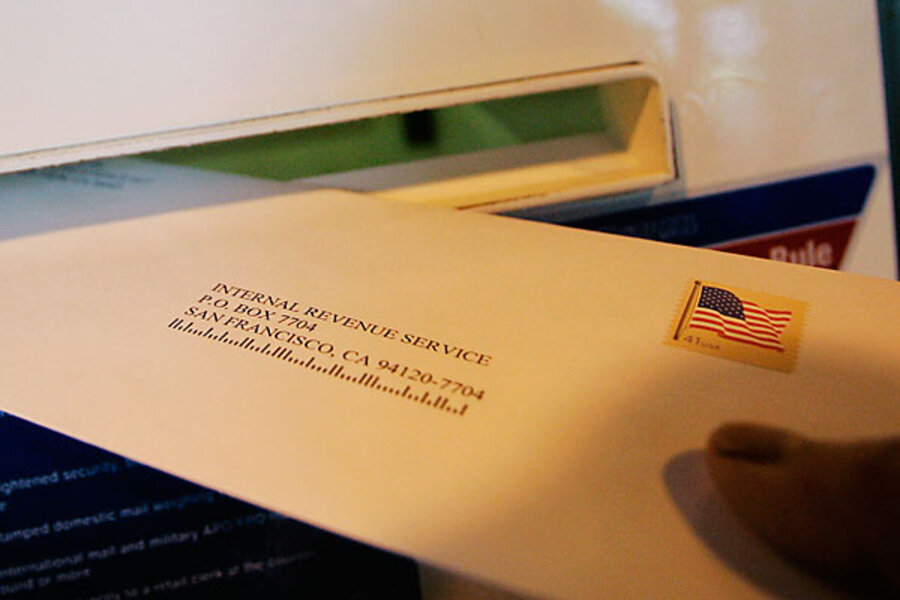

Tax day 101: how to file a tax extension form to the IRS

Loading...

If April 15 arrives and you're still not ready to file an income-tax return, don't panic.

You're not alone, and there's even a special piece of paper for people like you: IRS Form 4868. It's a single sheet that, when you mail it, can buy you an extra six months to prepare your federal taxes.

The catch: You still have to pay your taxes now – based on the amount you expect to show at the bottom of your tax form when you file it. Still, having a grace period is useful for people dealing with complicated tax issues.

Something similar to the IRS's tax extension form should available from your state as well.

Here's a Q-and-A, based on information from the Internal Revenue Service, for people who might want extra time:

When is the extension form due? Form 4868 must be postmarked or filed electronically by April 15, just like the regular tax returns.

How much do I need to pay, and what's the penalty for not paying? When you file Form 4868, pay the amount you expect to owe when you've finished preparing your return. If you underpay, you'll owe interest on the shortfall, plus a monthly late-payment penalty if you have not paid at least 90 percent of your total tax. The penalty is usually half of 1 percent of the amount unpaid.

What if I've finished my tax return but can't afford to pay? Don't file for an extension. File your return on time "and pay as much as you can," the IRS says. The agency will then send you a bill for the balance owed. You can often enter into an installment agreement with the IRS. But this involves filling out another piece of paper (Form 9465) and paying a setup fee ($52 to $105).

Can I file for another extension after six months? Generally not, so plan to be ready before Oct. 15, getting accounting help if needed.

Anything else I should know? According to the IRS, special rules may apply if you live outside the United States, including those in combat-zone military service. Also, the IRS has extension forms for other matters, such as corporate, trust, or family gift tax forms.

Also in Tax day 101:

Part 1: Top mistakes to avoid on your tax return

Part 2: Who pays no income taxes on April 15?

Part 3: How to file an IRS extension form

Part 4: How is the tax code changing under Obama?

Part 5: Are some states driving people out with high state taxes?

Part 6: How some millionaires can owe no taxes

Part 7: The tax code needs a fix – but exactly how?